About eldris

epr.eldris.ai leads the EPR sector, in fast, automated, AI Agent EU Complaince. LUCID Packaging, WEEE, and Battery Compliance for Brands, E-Commerce and Service based businesses expanding into the EU.

In This Article

- EPR registration costs vary significantly across European countries and product streams.

- Budgeting must include both registration and annual ongoing compliance fees.

- Automation tools help streamline multi-country compliance and reduce reporting errors.

- Choosing the right PRO significantly influences the accuracy of budgeting and compliance success.

- Hidden costs such as translation, training, and consultancy expenses must be factored in.

- 2025 introduces new harmonised rules—companies must act early to stay compliant.

Understanding EPR Registration Costs Across Europe

Why Fees Differ by Country and Product Type

The EPR registration price Europe imposes varied financial obligations depending heavily on national regulations and the specific product categories in question. This uneven landscape across the European Union can be daunting for producers, particularly those operating in multiple jurisdictions. For instance, registering packaging in France differs significantly from the same process in Germany or Spain, not only in cost but also in compliance expectations. Each country has its unique set of rules, authorities, and Producer Responsibility Organisations (PROs), driving cost variability.

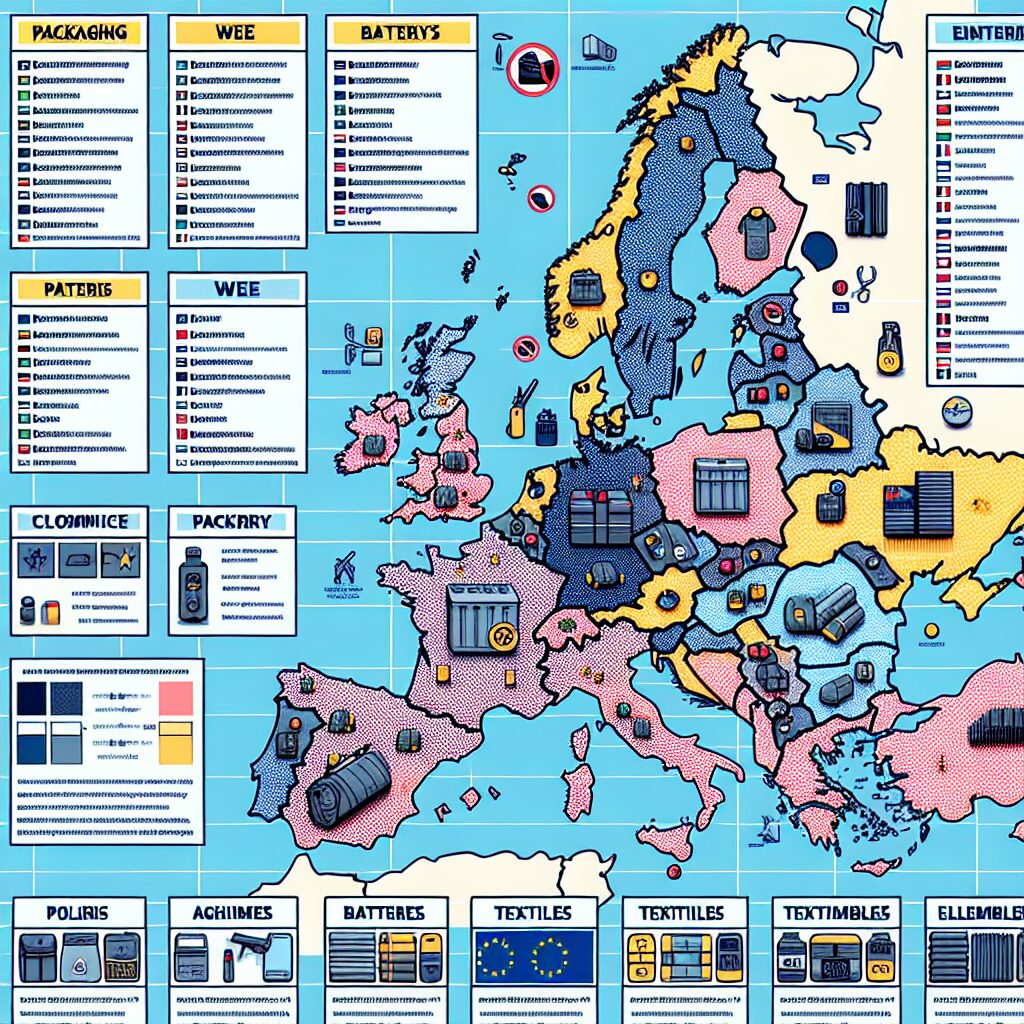

Product categories such as packaging, electronics (WEEE), and batteries carry their own specialised registration and reporting frameworks. Costs not only vary by nation but also depend on the material composition, market placement volume, and weight of the products. In some countries, small producers benefit from de minimis thresholds, which exempt them from registration unless certain turnover or volume limits are surpassed. Others offer no such relief, making it essential for businesses to assess their obligations accurately.

Moreover, local environmental priorities influence EPR fee structures. Countries with aggressive waste reduction targets tend to impose higher costs to incentivise sustainable design and recycling rates. For businesses, this means that the EPR registration price Europe is not a static figure but a dynamic one that reflects the regulatory and environmental ethos of each member state.

Registration vs Annual Licensing Costs

Breaking Down Ongoing Obligations

Understanding the distinction between initial registration fees and annual licensing costs is fundamental in predicting the total EPR registration price Europe. Registration is typically a one-time action that formally enters the business into the regulatory system of a given country. This may incur a modest administration fee, or in some cases, be free. However, registration is only the beginning.

The bulk of financial planning must consider ongoing obligations. These include annual compliance fees paid to PROs, material fees for waste collection and treatment, as well as possible audit and consulting expenses. Each year, producers must declare the quantity and type of goods placed on the market. Based on this data, PROs calculate corresponding fees. Some countries also impose fixed dues for administrative upkeep, while others adjust annually in accordance with inflation and recycling rates.

Non-compliance or inaccurate reporting can result in penalties, potentially doubling or tripling the anticipated cost. As such, companies must factor this risk into their budgeting, ensuring systems are in place for meticulous data collection and timely declarations. The line between registration and ongoing fees is blurred; for effective financial forecasting, both must be treated as integral components of the overall EPR registration price Europe.

“EPR compliance begins with registration, but true cost control depends on how you manage ongoing responsibilities.”

Budgeting Strategically for 2025 EPR Costs

As 2025 introduces increasingly harmonised regulations across Europe, businesses must strategically budget for EPR compliance. Begin by listing every country in which your products are placed on the market. Next, identify applicable EPR categories and the corresponding regulations. With that map in hand, calculate the direct registration costs and the more complex indirect costs such as material contributions, reporting infrastructure, and professional consultations.

One key budgeting element is the growing importance of digital compliance tools. Automated systems and EPR software can centralise reporting across countries, significantly reducing human error and associated penalties. These tools may come with an upfront price tag, but over time they reduce administrative burden and improve budgeting precision.

Also, plan for inflation and legislative updates. Historical trends show that fees trend upward, particularly as recycling targets and environmental expectations rise. Finally, businesses should maintain a contingency budget for unforeseen compliance issues, including incorrect filings or sudden regulatory changes. With proper foresight, companies can manage the EPR registration price Europe as a predictable operational cost, rather than an uncontrollable liability.

Comparing Country-Specific Fee Structures

European nations utilise diverse fee calculation models that heavily influence the final EPR registration price Europe. Germany, for example, employs the VerpackG (Packaging Act), requiring producers to register with the LUCID Packaging Register and contract with a PRO. Costs depend on weight and type of material. Reporting inaccuracies result in fines or delisting from marketplaces like Amazon.

In France, the EPR registration includes an eco-modulation framework. Products with higher recyclability may benefit from fee reductions, while those containing problematic materials face surcharges. Similarly, Italy’s CONAI system levies fees based on packaging type—aluminium and plastic receive different rates compared to cardboard or glass.

Some Eastern European markets offer relatively lower fees but may require more manual processes, increasing administrative overhead. The UK, now outside the EU, still impacts regional trade as it enforces its own EPR model, which shares many similarities but contains crucial differences in scheme structure and reporting frequency.

Comparing these models side-by-side is essential. Websites such as Comprehensive 2025 EPR participation fees and government portals provide detailed fee schedules, while consultants offer comparative matrices. A failure to understand the structure in one market can lead to erroneous budgeting and potential fines, significantly inflating your EPR registration price Europe.

Forecasting Costs with PROs and Material Contributions

Producer Responsibility Organisations (PROs) play a central role in EPR compliance, administering waste collection systems and managing reporting frameworks. The fees charged by PROs are one of the largest components of the overall EPR registration price Europe. These fees are calculated based on volume and type of materials introduced to the market.

In 2025, many PROs are updating their contribution models to reflect evolving EU circular economy priorities. Lightweight and low-recyclability materials may face significant cost increases. On the other hand, materials with high recovery rates, particularly paper and metals, may experience stable or reduced contributions.

Negotiating contracts with the appropriate PRO is vital. Businesses should shop around if more than one PRO operates within a country. Transparency in pricing and support services should factor into the selection process. Additionally, many PROs offer bundled services, including audit assistance and consolidated reporting tools to simplify multi-country obligations.

Packaging Stream Costs in 2025

Packaging remains the most widespread EPR category in Europe, affecting manufacturers, importers, and retailers alike. In 2025, companies will pay fees not only for base material types but also based on the recyclability of full packaging systems. For example, multilayer plastics or composite packaging often face substantial surcharges.

France’s 2025 fee modulation scheme highlights this trend—clear PET bottles may incur lower rates, while coloured plastics or composite items could see surcharges of up to 50%. Meanwhile, Spain offers discounts for reusable packaging systems. Most countries are now linking pricing with Design for Recycling principles, thus rewarding environmentally conscious packaging decisions.

Tools like eco-modulation calculators provided by national agencies can assist in budgeting. It’s also wise to integrate packaging engineers or sustainability consultants who understand cost drivers deeply. Businesses must now treat packaging not just as a functional asset, but as a financial liability within the broader EPR registration price Europe conversation.

WEEE and Battery Registration Trends

Electronics (WEEE) and batteries carry some of the strictest EPR obligations. In recent years, their fee structures have become increasingly complex as reverse logistics and processing costs rise. In 2025, producers of electrical goods must report by device category and weight, with distinct rates applied to small appliances, IT equipment, or lighting products.

Battery-related obligations require manufacturers to contribute towards safe recycling and hazardous waste management. Portable, industrial, and automotive batteries are priced differently, and improper declarations may expose the producer to severe fines.

Due to increased scrutiny from enforcement bodies, especially in Germany and Scandinavia, many firms now outsource compliance for these categories. Third-party providers can handle everything from registration to reporting, thus offering financial predictability. Nevertheless, these services come at a cost, which firms must include when evaluating the comprehensive EPR registration price Europe.

Automation Tools for Managing Multi-Country Compliance

Automation is revolutionising how businesses handle EPR obligations across Europe. Centralised platforms now allow producers to track registration status, submit reports, and generate country-specific invoices under one dashboard. These tools mitigate human error, ensure deadline adherence, and simplify data consolidation for audits.

Some EPR software also integrates with ERP systems, automatically extracting packaging weights and material compositions from product databases. This dramatically reduces labour costs and improves data accuracy. Firms operating in 5 or more countries often recoup the software investment within the first year due to efficiency gains.

Popular tools include those offered by compliance specialists mentioned on Upcoming 2025 EU product safety changes or internal tools built into marketplaces like Amazon Seller Central. Businesses should evaluate functionality, data security, and localisation features before committing. However, regardless of tool choice, automation significantly optimises long-term handling of EPR registration price Europe obligations.

Hidden Costs to Watch in EPR Implementation

Failure to account for indirect or hidden costs can derail EPR budgeting. Common unforeseen expenses include translations for local document submissions, consultant fees for compliance audits, and fines due to delayed reporting. Some countries require in-country fiscal representatives, adding another layer of compliance expense.

Training internal teams on compliance obligations is also essential and entails scheduling, productivity loss, and content creation expenses. Additionally, obtaining or generating weight and material data for product catalogues can require significant in-house or outsourced labour—especially for legacy products lacking documented specifications.

These aspects, when overlooked, compound to significantly increase the effective EPR registration price Europe. Proactive companies must budget beyond the apparent base fees and consider total cost of compliance for a realistic forecast.

Choosing a Producer Responsibility Organization (PRO)

Selecting the right PRO for each market is a strategic decision that influences both cost and operational reliability. Criteria should include fee transparency, service breadth (e.g., audit support, training), and responsiveness. In nations like France or Italy where multiple PROs are available, competition may even enable bargaining on service bundles or value-added support.

Some PROs also offer harmonised regional coverage via alliances or consortiums, enabling simplified compliance across multiple countries—ideal for companies distributing widely across the European Economic Area. References, reviews, and SLAs should be considered—mistakes or inaccessibility could result in non-compliance and increased operational costs.

Utilising internal tools from providers listed in Learn more about Extended Producer Responsibility (EPR) in Europe, businesses can make informed, data-driven decisions when evaluating which PROs best suit their EPR profile.

Getting Ready for New Rules in 2025

In 2025, the EU is not only fine-tuning existing directives but introducing new standardisations in reporting, fee modulation, and enforcement. For instance, producers will need to submit digitalised packaging design data, and stricter financial penalties will be imposed on late or false reports. The Commission aims to drive uniformity in data transparency across member states.

Complying with these new mandates may necessitate system upgrades, staff reskilling, and revised vendor contracts—all of which impact a company’s EPR readiness. Firms should conduct gap assessments by Q3 2024 to avoid disruption. The benefits of early compliance include smoother audits and potential fee reductions under performance-based frameworks.

More information on these regulatory shifts can be previewed via Read a related article, along with checklists to guide 2025-preparedness planning.

Final Thoughts on EU-Wide Compliance Planning

[CONCLUSION_CONTENT]

In conclusion, mastering the EPR registration price Europe requires more than understanding basic costs. It demands international coordination, precise data management, forward-looking budgeting, and correct selection of PROs. By investing in automation, anticipating regulatory evolution, and preparing for hidden costs, companies can convert compliance from a liability into a managed strategic function. As EU law unifies expectations across member states, those best prepared will find themselves at a competitive advantage in both cost and operational efficiency.

Great guide on 2025-epr-registration-price-europe-budget-guide – Community Feedback

How much is EPR registration in Europe for 2025?

EPR registration costs in Europe for 2025 vary by country and product stream. Typical prices start around €25–€200 for registration, with annual licensing fees dependent on product type, volume, and materials. Complex packaging, electronics, or batteries may incur higher ongoing costs.

What should businesses budget for EPR compliance in 2025?

Businesses should budget for registration fees, annual reporting costs, eco-modulated fees based on materials, and possible consultancy or automation solutions. For growing e-commerce sellers, budgeting at least €300–€1,000 per country is advisable.

Are EPR fees harmonised throughout the EU?

No, EPR registration, reporting and licensing fees are set by national authorities or PROs. Fee structures, minimum charges, and material categories differ significantly between countries, so businesses with multi-country operations must plan and register accordingly.