About eldris

epr.eldris.ai leads the EPR sector, in fast, automated, AI Agent EU Complaince. LUCID Packaging, WEEE, and Battery Compliance for Brands, E-Commerce and Service based businesses expanding into the EU.

In This Article

- Start EPR Fee Calculation months ahead of EU launches to avoid last-minute surprises.

- Account for packaging, battery, and WEEE costs in your forecast model.

- Use automated tools and spreadsheets to build country-specific declarations.

- Validate estimates with PROs and internal audits prior to product go-live.

- Consider margin impacts and price sensitivity from additional per-unit levies.

- Track historic EPR data to predict fee increases or administrative shifts.

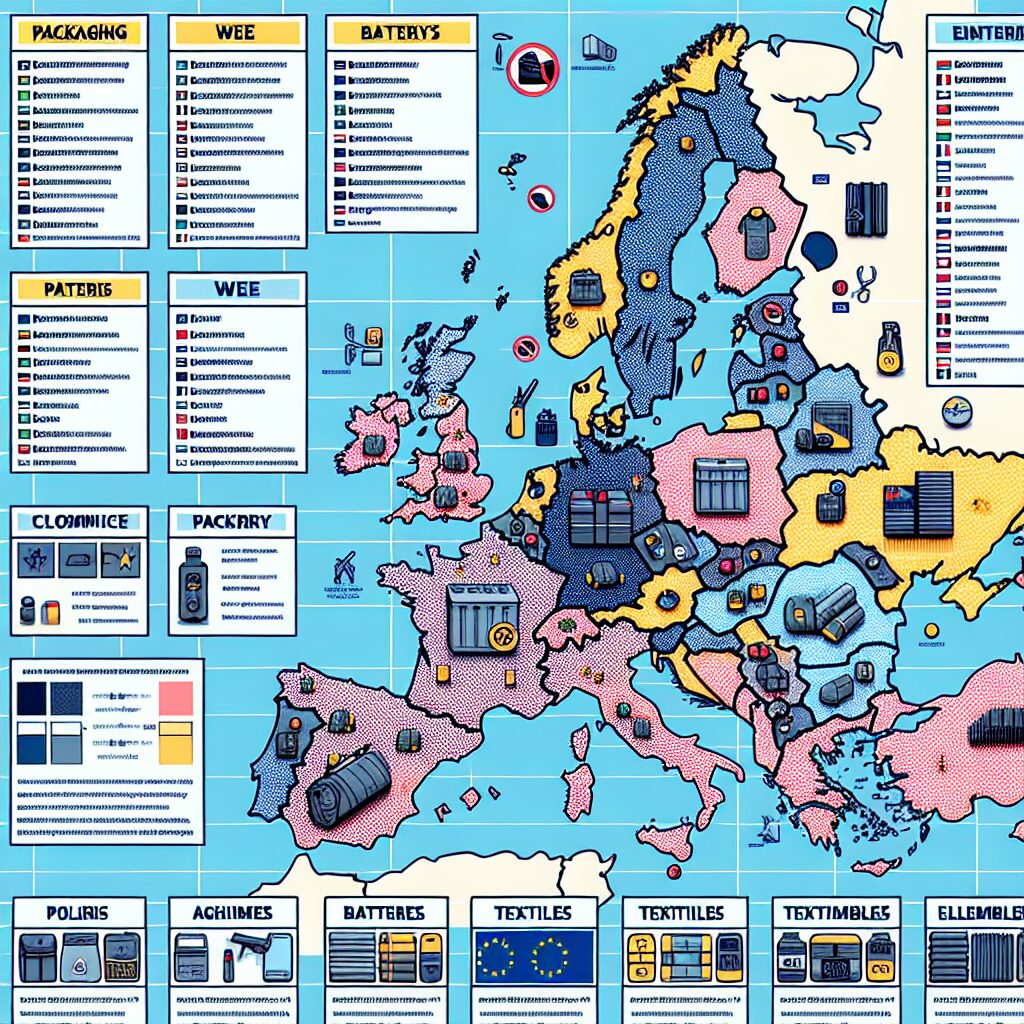

Understanding Your EPR Fee Obligations by EU Country

Different Producer Responsibility Organizations

When entering the European Union market, businesses face an intricate web of Extended Producer Responsibility (EPR) schemes. EPR Fee Calculation becomes both essential and nuanced due to the fragmented regulatory landscape across EU member states. Each country has its own legislation and often relies on one or more Producer Responsibility Organisations (PROs) to administer recycling obligations. These organisations vary both in structure and in their fee methodologies.

For example, France mandates registration with organisations like Citeo for packaging, while Germany operates through the Zentrale Stelle Packaging Register (ZSVR). Some Eastern European nations rely heavily on government-affiliated PROs, whereas Nordic countries generally favour private sector collaborations. This variation makes EPR Fee Calculation particularly challenging when operating across multiple jurisdictions.

Moreover, fee structures differ not just from country to country, but also by material type, weight, and usage. In some regions, eco-modulated fees apply, meaning that the more recyclable your material, the lower the cost. Understanding country-specific obligations is thus the first critical step in precise EPR forecasting. Brands should always consult with local PROs and check up-to-date fee tables for each product category. See Learn more about EU Extended Producer Responsibility (EPR) Compliance for an overview tool comparing EPR structures in key markets.

How Material Type and Volume Influence EPR Fees

Why Weight and Recyclability Matter

Material choice and volume output are two of the most influential factors in EPR Fee Calculation. Every tonne of material, whether plastic, cardboard, aluminium, or glass, carries a different cost profile depending on recyclability and environmental impact. Heavier materials like thick polymers or composite packaging typically incur higher fees, not merely because of their weight but also due to their end-of-life processing challenges.

Eco-modulation—used by countries such as France and Italy—rewards designs that include fewer materials or use easily separable layers. Therefore, multilayer plastics or packaging with metallic elements may lead to fee increases. Brands should consider both the gross and net weights of their packaging units and consult national fee guidance on modulated rates.

Volume becomes critical when forecasting annual liabilities. Even modest increases in shipment numbers can substantially raise your annual EPR budget, especially across multi-channel fulfilment operations. Smaller batch sizes or delayed launches can mitigate EPR exposure in the initial calendar year. For designers and operations teams, material audits early in the product lifecycle can drastically reduce long-term compliance costs. Automate your Germany VerpackG compliance for 2025 provides a downloadable matrix of EU EPR fees by material type and geography.

Fee Modelling Techniques By Product Type

Once you’ve understood the geographic and material-related variables in EPR Fee Calculation, the next logical step is to model fees according to product categories. Common groupings include consumer electronics, household goods, textiles, cosmetics, and food products. Each stream may be governed by tailored WEEE, batteries, or packaging directives. For instance, a mobile phone may attract fees under all three categories simultaneously.

To build an effective model, input SKU-level data such as packaging type, unit quantity per shipment, forecasted monthly sales, and disposal method. Assign variable rates based on each country’s fee tables, structured by weight and material. Using scenario planning, estimate net total liabilities for optimistic, baseline, and pessimistic sales levels.

Advanced forecasting models integrate local holidays, marketing pushes, and seasonality data, all of which affect in-market inventory levels. Remember to build models with extendible logic, so when PRO fee rates change—often on an annual basis—they can be quickly updated. Custom EPR calculators or Excel spreadsheets with lookup tables are essential tools when managing multiple SKUs and geographies simultaneously. See Read a related article for a downloadable template to do this with packaging materials.

Estimating Costs Across Packaging, Battery & WEEE Streams

EPR Fee Calculation isn’t restricted to packaging alone. For many product categories, you’re likely to encounter overlapping obligations across Batteries and WEEE (Waste Electrical and Electronic Equipment) in the EU. Packaging tends to be the dominant stream in terms of frequency, but WEEE and battery obligations can often carry higher fees per unit due to their toxicity or manual recycling requirements.

Let’s break this down:

- Packaging Fees: Based on weight, recyclability, and type. Often the lowest per unit but can increase rapidly with volume.

- Battery Fees: Governed by both weight and chemical composition. Lithium-ion, for instance, carries significantly higher rates than alkaline counterparts.

- WEEE Fees: Applicable to products with circuitry, screens, or electrical components. PROs calculate this surcharge by combining weight tiers with hazardous components classification.

To estimate integrative costs, businesses should assign each SKU into well-structured product streams and apply compound cost formulas. These initial modelling steps ensure brands are not blindsided by cross-fee obligations at customs or first market entry.

Using Product Launch Timing to Predict Annual Fee Deltas

Timing a product launch can significantly shift your forecasted EPR fees. In most EU countries, EPR fees are calculated on an annual declaration basis, often linked to calendar years. A launch in December, therefore, could incur full-year fees with minimal sales to offset the cost. Conversely, delaying the launch to January allows a full twelve months of revenue-generating units to absorb the associated EPR burden.

This timing sensitivity should be a crucial lever in your EPR Fee Calculation strategy. It’s especially critical during end-of-year budget cycles, Q4 promotions, or black Friday campaigns. Companies should model the margin impact of delaying launch by a few weeks versus facing an unbalanced annual declaration.

When builds are finished mid-calendar, soft launches through pilot markets or courier-based shipments under threshold values can reduce declared volume until the new year. Slick coordination between regulatory, marketing, and logistics departments ensures the lowest total cost of compliance per unit sold.

Building Calculators from Historical EPR Fee Trends

Historical data provides one of the strongest foundations for predictive EPR Fee Calculation. Most PROs publish past annual rate tables that allow backward modelling of cost-per-SKU. Over time, these rates show identifiable trends—plastic surcharges increasing, glass stabilising, and aluminium improving in light of industrial recycling improvements.

Extracting such historic tables into time-series databases enables regression analysis and the creation of proprietary fee prediction algorithms. While fee announcements usually happen with three to six months’ lead time, early indicators from trade groups and environmental lobbies can enhance your forecast engine.

Historical patterns are also useful for auditing existing forecasts. Did the 2021 prediction match actual invoices in France or Poland? Where were the material usage assumptions off? Forward-looking teams integrate these calibration processes into monthly reporting to improve future estimation accuracy.

Top 5 Mistakes Brands Make When Forecasting EPR

Even seasoned companies face pitfalls in EPR Fee Calculation. Below are the five most common errors observed in cross-market launches:

- Ignoring Local Registration Rules: Simply shipping to the EU does not equal compliance. Each country requires specific registration, often before first sale.

- Overlooking Battery and WEEE Streams: Many brands focus on packaging fees only. This results in compliance gaps and fines for electronics and hybrid SKUs.

- Underestimating Seasonal Volume Increases: EPR fee declarations are often retrospective. A surprising Q4 surge can cause unplanned levies the following March.

- Failing to Model Price Sensitivity: For products with tight margins, even small per-unit fees require pricing adjustments that brands often overlook.

- Not Updating Forecasts with New Fees: Fee updates are frequent. Brands that fail to monitor PRO rate changes can erode profit without noticing.

Solutions: How Automation Tools Improve Accuracy

Automation is rapidly transforming EPR Fee Calculation. From real-time data pulls on unit sales to API integrations with PROs, companies now have the tools to auto-populate forecasts with accurate estimations. Software platforms can sync with ERP systems, ensuring sales and shipment data flow directly into EPR dashboards.

Many tools include compliance checks against registration databases, ensuring that invoiced product volumes align with reported ones. Some vendors also offer dynamic calculators which adjust fees based on real-time packaging changes or new SKUs. By integrating automation early, brands reduce human error and gain faster adaptation in multi-country settings.

Additionally, automated alerts before rate updates or inadequate declarations allow proactive course correction. This is particularly important across fragmented jurisdictions. Investing in these tools pays off through lower compliance costs and fewer regulatory disruptions to market expansion.

How EPR Impacts Margins & Pricing in International Sales

Perhaps the most understated element of EPR Fee Calculation is its impact on unit economics and gross margin. In highly competitive categories like electronics or FMCG, an additional €0.15 per unit could reduce net margin by several percentage points. That is especially true if margin estimates did not include accurate EPR forecasts.

Brands must integrate EPR liabilities into pricing models from the outset. This could involve creating regional pricing strategies, where retail prices in Germany reflect higher PRO costs than in Bulgaria or Slovenia. Alternatively, brands may opt for a uniform pan-EU price and spread costs to prevent pricing disparity.

The broader implication is strategic. Inaccurate EPR forecasts may lead to re-launches, product redesigns, or even discontinuations. Modelling these impacts early ensures brands remain both compliant and profitable while boosting investor confidence.

Next Steps: Validating Forecasts Prior to Product Launch

Forecast validation is the final pillar of robust EPR Fee Calculation. Initial estimates should pass through internal audits and regulatory reviews. Engage directly with PROs to validate calculations using sample data. For complex scenarios, work with third-party compliance consultants to conduct data reviews, especially for blended materials or battery-powered SKUs.

A best practice includes A/B testing EPR forecasts by launching in test markets before full-scale deployment. Most importantly, create a feedback loop where variance between actual and forecasted fees is analysed monthly, with lessons applied to future product cycles.

Re-check fee modelling when introducing packaging innovations or controlling suppliers, as even a minor material change can trigger large declaration changes.

“Accurate EPR Fee Calculation is not just a compliance requirement; it’s a strategic necessity for profitable EU market entry.”

Conclusion: Commit to EPR Forecasting Early

[CONCLUSION_CONTENT]

Great guide on forecasting-epr-recycling-fees-when-entering-the-eu-unexpected-epr-fees-erode-margins-on-eu-launches-this-methodology-shows-how-to-model-packaging-battery-and-weee-fees-using-volume-material-and – Community Feedback

How are EPR fees calculated?

EPR fees in the EU are typically determined by the type, weight, and recyclability of the packaging, batteries, or EEE placed on the market. Calculations often consider material types, volumes, and fee structures set by Producer Responsibility Organizations (PROs) in each country.

What is EPR in recycling?

EPR, or Extended Producer Responsibility, is a policy that requires companies to take financial and organizational responsibility for the recycling of packaging, batteries, or electronic goods they introduce in the EU.

How to reduce EPR fees?

One effective way to lower EPR fees is by lightweighting packaging—reducing material weight—because fees are often calculated based on total packaging weight placed on the market.

What are EPR obligation charges?

EPR obligation charges are specific fees that companies must pay for each material type used in packaging, battery, or electronic waste, depending on its recyclability, prevalence, and country-specific rules.