About eldris

epr.eldris.ai leads the EPR sector, in fast, automated, AI Agent EU Complaince. LUCID Packaging, WEEE, and Battery Compliance for Brands, E-Commerce and Service based businesses expanding into the EU.

In This Article

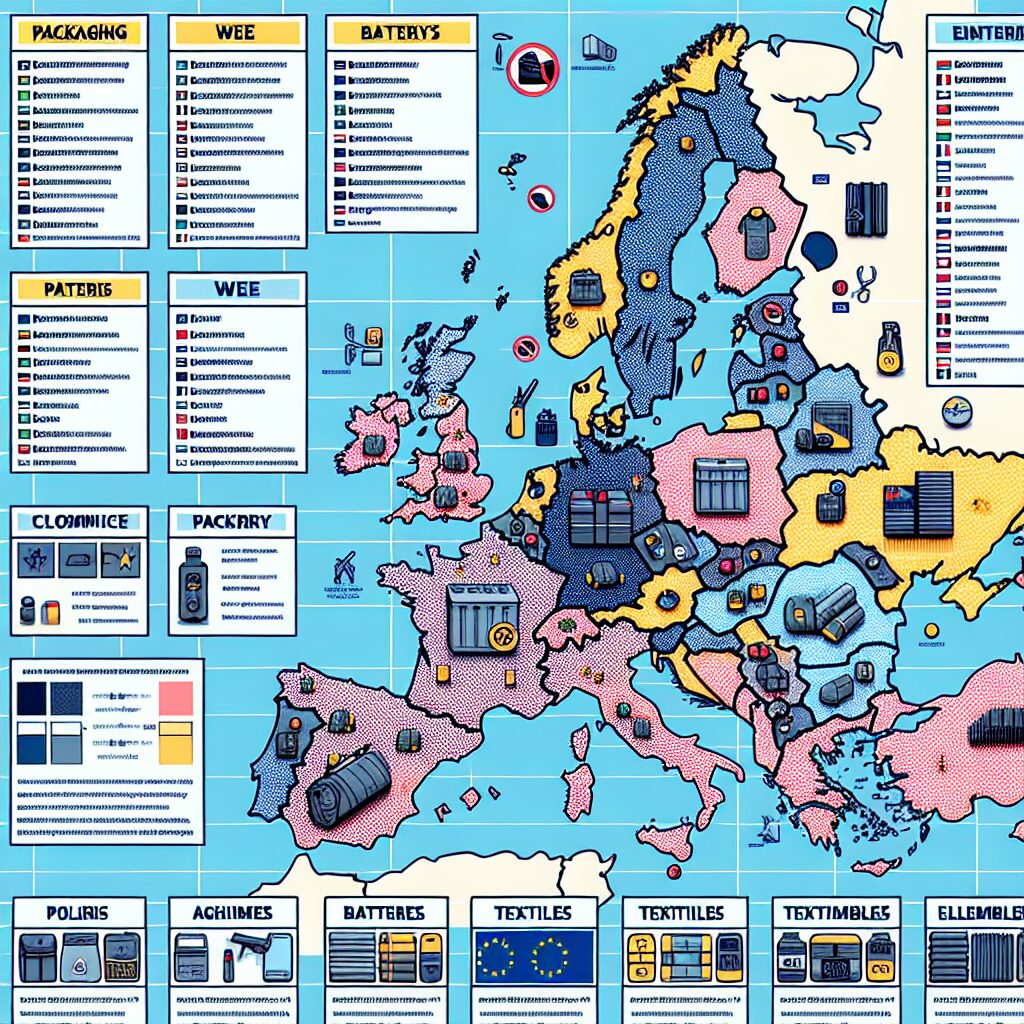

- EPR Regulations apply differently in each EU member state, requiring local compliance tactics.

- Packaging, WEEE, and batteries are the core product categories regulated under EPR laws.

- Marketplaces increasingly verify EPR compliance before allowing listings in certain nations.

- Failure to comply may result in legal action, delisting, customs delays, and loss of market access.

- Using specialised tools and partners can mitigate complexity and improve long-term compliance health.

Understanding EU-wide EPR Regulations

What is Extended Producer Responsibility?

Extended Producer Responsibility (EPR Regulations) is a policy approach under which producers are given significant responsibility—financial and/or physical—for the treatment or disposal of post-consumer products. Within the European Union (EU), this framework has been applied most notably in the management of packaging waste, Waste Electrical and Electronic Equipment (WEEE), and batteries. The goal is to make manufacturers, importers, and online sellers accountable for the entire lifecycle of their products, encouraging eco-design and sustainable disposal practices.

EPR Regulations are embedded in various EU directives including the Packaging Waste Directive (94/62/EC), the WEEE Directive (2012/19/EU), and the Batteries Directive (2006/66/EC). However, member states implement these directives with country-specific nuances, resulting in a fragmented compliance environment. Producers must understand not only pan-European principles but also the adjustments each national government applies to stay legally compliant.

Country-by-Country EPR Packaging Comparison

EPR Rules for Packaging Materials

The EPR Regulations for packaging materials vary considerably across EU member states. While the overarching directive mandates that companies placing packaging onto the market take responsibility for its end-of-life treatment, local interpretations affect registration processes, fees, categories, and enforcement timelines.

Germany’s VerpackG requires all producers and first distributors of packaged goods to register with the Central Packaging Register (Zentrale Stelle Verpackungsregister), appoint an authorised representative, and participate in a dual system scheme. In contrast, France imposes extended labelling and eco-modulation fees under its Loi AGEC framework, which includes design incentives for recyclability. Spain has instituted legislation aligning with the new EU Packaging and Packaging Waste Regulation, focusing sharply on reuse and reduction targets.

Meanwhile, small economies like Luxembourg and Croatia offer simplified packaging compliance mechanisms for businesses generating below certain thresholds, while countries like Italy enforce regional consortium affiliations (e.g., CONAI) and variable fee matrices depending on material and recyclability status.

“EPR compliance success hinges on localisation—understanding the granular, country-specific rules is more than a best practice; it’s a legal necessity.”

WEEE Compliance Gaps and Variations

Waste Electrical and Electronic Equipment (WEEE) regulations are governed by the WEEE Directive, but again, implementation diverges significantly between member states. EPR Regulations around WEEE mean producers must finance the collection, treatment, and recovery of electrical waste. Still, national agency roles, reporting cycles, and product categorisations create complexity.

In the Netherlands, every entity placing electronic goods on the market—regardless of sales volume—must register with Stichting OPEN and report quantities bi-annually, distinguishing between professional and consumer devices. In contrast, Poland enforces annual quotas and relies on publicly available producer databases. Germany divides WEEE categories more strictly and levies substantial fines for misclassification.

Language barriers also hinder clarity around reporting templates and acceptable estimations. For marketplaces and cross-border sellers using fulfilment centres or local warehousing, local WEEE registration is almost universally required—obligating entities to maintain duplicate compliance across jurisdictions.

Battery Rules Across EU Member States

Under the Batteries Directive, all producers of batteries—including primary, rechargeable, and industrial cells—must ensure proper collection, labelling, and recycling efforts throughout the EU. However, specific expectations for labelling, submission deadlines, and take-back schemes vary widely, compounding the burden on cross-border operators under EPR Regulations.

In Belgium, Recupel manages a centralised battery scheme with steep flat-rate penalties for non-registration. France requires annual declarations through Accredited Producer Responsibility Organisations (PROs), often tracked through intricate declarations via ADEME. Meanwhile in Sweden, producers need to register with the Swedish Environmental Protection Agency and submit quarterly updates even for negligible volumes.

Moreover, the upcoming EU Battery Regulation (EU/2023/1542), set to replace the current Batteries Directive, will strengthen rules on carbon footprint disclosure and corporate due diligence. Proactive compliance now avoids retroactive adjustments later.

Deadlines and Filing Requirements Country-by-Country

Deadlines for filing EPR reports and registering producer status are among the most variable elements across EU members. These differences make maintaining compliance a logistical challenge. In Austria, packaging reports must be submitted quarterly, while Slovenia requires just one annual filing. The UK, though now a non-EU state, still influences regional standards and has converted prior EU obligations into its UK Packaging Waste Regulations, maintaining quarterly submission cycles.

Filing frequency can also depend on turnover and volume thresholds. Germany uses de-minimis thresholds exempting smaller operators from monthly reporting while still requiring yearly filings. Spain mandates monthly labelling audits for e-commerce heavyweights, while Greece’s EWRA system requires dual filings—both to the government and to affiliated take-back schemes.

Digital platforms and online marketplaces are increasingly requesting proof of compliance uploads to allow continued selling privileges, tightening reporting windows for sellers and brands alike.

Compliance Impacts for Cross-Border Sellers

EPR Regulations present unique challenges for cross-border sellers due to inconsistent national standards and the necessity for local representation. For Amazon FBA sellers, for example, storing goods in Germany triggers the need for LUCID registration and participation in the dual system, independent of any other EU market activity.

Country-specific agencies often refuse foreign addresses, meaning online traders must either establish local entities or appoint Authorised Representatives (ARs) within each jurisdiction. Furthermore, payment of eco-contributions and presentation of compliance documentation has become prerequisite for establishing logistics partnerships, warehousing contracts, and marketplace access.

Failure to comply can result in delisting, confiscation of stock, website takedowns, or even blacklisting by customs. Increasingly, this compliance is being enforced at the border, with customs authorities requesting EPR registration certificates for import clearance.

Learn more about Extended Producer Responsibility in the EU

Marketplace Requirements and Enforcement

Marketplaces have become active enforcers of EPR Regulations. Amazon, Otto, Zalando, eBay, and Rakuten now require EPR numbers for packaging and WEEE compliance before vendors can list items in countries like France and Germany. This change stems from the EU’s Seller Liability Directive and the Digital Services Act (DSA), both of which require platforms to ensure third-party sellers come into regulatory alignment.

These marketplaces have implemented automated compliance checks. For example, Amazon Seller Central prompts packaging EPR uploads under “Compliance documents”, tying compliance to ASIN blocking mechanisms. Sellers who fail to present proof of registration are subject to delisting or temporary suspension.

Moreover, marketplaces are mandating authorised seller declarations, shifting liability down the supply chain. This development means even dropshippers and resellers must register and report under EPR, regardless of fulfilment arrangements.

Automated Tools for EPR Management

Managing EPR compliance without the help of automation is becoming increasingly unsustainable. E-commerce sellers operating in multiple countries are adopting compliance software tools to track deadlines, fees, and reporting formats in real-time. These platforms integrate with marketplaces and accounting software to generate submission-ready files.

Tools like EcoComplianceHub and GreenNova allow country-specific tracking using AI-driven alerts. Others like EPRAssist automate invoice submission, decluttering manual bureaucracy. Some software providers also offer APIs that directly upload registrations to country databases, eliminating hand-off errors and latency risks.

These solutions help businesses achieve audit transparency, reduce human labour dependencies, and scale operations while maintaining regulatory alignment under evolving EPR Regulations.

Selecting an EU Compliance Partner

Choosing the right compliance partner is crucial. Firms such as Landbell Group, Reclay, and Interzero offer pan-European EPR services covering registration, fee management, authorised representation, and direct engagement with national authorities.

When selecting a partner, ensure they offer multilingual support, legal updates on regulatory changes, and specialist counsel in packaging, batteries, and WEEE channels. Seek entities that hold accreditations with national registers such as LUCID (Germany), ADEME (France), or SIGRE (Spain).

It’s also vital to assess the scope of your compliance partner’s integration offering. Will they work with your enterprise resource planning (ERP) system? Do they offer scalable support for SKU-level reporting? Avoid vendors who limit their expertise to packaging only, regardless of your portfolio diversity.

How to choose the right EU compliance partner

Conclusion: Aligning with EPR Futures in the EU

[CONCLUSION_CONTENT]

The patchwork nature of EPR Regulations across the EU mandates careful navigation. Compliance isn’t merely a question of ethics or public perception—it is now a practical imperative for continued market access. As enforcement tightens, regulation evolves, and sustainability expectations rise, businesses must adopt proactive, tech-driven strategies to remain viable and legally sound within the European landscape.

A forward-looking approach to EPR involves a potent mix of awareness, automation, and active management. Partnering with qualified compliance agents, staying informed about country-specific shifts, and deploying scalable tools will distinguish compliant, reputable sellers from those left behind.

Great guide on eu-epr-compared-packaging-weee-and-batteries-by-country – Community Feedback

What is the EPR legislation in Europe?

EPR, or Extended Producer Responsibility, is a legal framework in Europe that makes producers responsible for the collection, sorting, and recycling of products, especially packaging, WEEE, and batteries, introduced across the EU to promote recycling and reduce waste.

Which countries have EPR for packaging?

Most EU and EEA countries have EPR schemes for packaging, including Belgium, Bulgaria, Estonia, Finland, Greece, Ireland, Croatia, Luxembourg, Norway, Austria, Poland, Portugal, Romania, Switzerland, Slovakia, Slovenia, Spain, Czech Republic, Turkey, and Hungary.

What does EPR stand for in packaging?

EPR stands for Extended Producer Responsibility, which makes packaging producers legally responsible for the management and recycling of packaging materials they place on the market.

What is extended producer responsibility?

Extended producer responsibility (EPR) is an environmental policy approach in which producers are given significant responsibility for the treatment or disposal of post-consumer products, encouraging sustainable product design and reducing environmental impact.