About eldris

epr.eldris.ai leads the EPR sector, in fast, automated, AI Agent EU Complaince. LUCID Packaging, WEEE, and Battery Compliance for Brands, E-Commerce and Service based businesses expanding into the EU.

In This Article

- Weee compliance fees are essential legal obligations for EEE sellers in the EU.

- Fee calculations vary by country, product category, and scheme structure.

- Eco-design can reduce costs through eco-modulation incentives in markets like France.

- E-commerce brands must manage separate registrations for each EU Member State.

- Automation and EPR platforms help reduce cost, error, and risk.

- Budgeting must account for reporting, registration, and scheme-level costs.

- Future regulations will increasingly favour digital and traceable product documentation.

- Producers should act proactively to remain compliant and competitive in 2024.

What Are WEEE Compliance Fees?

Definition and Legal Requirements

WEEE compliance fees refer to the mandatory payments made by electrical and electronic equipment (EEE) producers in the European Union under the Waste Electrical and Electronic Equipment (WEEE) Directive. These fees are imposed to cover the costs associated with the collection, recycling, and environmentally responsible disposal of electronic waste. The directive is a cornerstone of the EU’s environmental policy, aiming to reduce the harmful effects of e-waste on both human health and the environment.

Under EU law, any business – whether located inside or outside the EU – that places EEE onto the EU market is considered a “producer”. These producers, including online retailers and manufacturers, are required to register with relevant national authorities and pay WEEE compliance fees accordingly. The legislation prescribes that producers must report quantities and categories of equipment sold and finance their end-of-life disposal. Failure to comply can lead to significant fines, product bans, or exclusion from certain markets. Therefore, proper understanding of weee compliance fees is not just a matter of corporate responsibility but also of legal necessity.

How WEEE Fees Are Calculated

By Country Weight Category and Scheme

The computation of weee compliance fees is a multifactorial process, varying significantly depending on the country, product category, product weight, and local compliance scheme. At the core, it’s a cost-per-kilogram model, where each category of EEE – such as large household appliances, IT equipment, or lighting – is associated with a specific rate that reflects the disposal and recycling expenses inherent to that category.

For instance, in Germany and France, fees for Category 3 (IT and telecommunications equipment) may differ massively not only in cost per kilogram, but also in reporting format, frequency, and even data precision. Similarly, some countries apply base fees in addition to volume-based costs, resulting in non-linear expenses – especially for small producers. These nuances make budgeting for weee compliance fees highly complex without expert guidance or automation.

“WEEE fee structures are as diverse as the European Union itself — localisation is the key to cost accuracy.” – EU Compliance Analyst

2024 WEEE Fee Comparison by EU Country

The 2024 landscape of weee compliance fees highlights stark variations across EU nations. For example, Sweden generally exhibits lower per-kilogram rates due to its robust recycling infrastructure, whereas countries like Italy and Spain have higher rates driven by regional collection costs and administrative surcharges. In France, an eco-modulation scheme rewards eco-design with lower fees, encouraging innovation in recyclability.

Here is a brief comparative overview:

- Germany: €0.15 – €0.40/kg depending on product category

- France: €0.25 – €0.60/kg with eco-modulation incentives

- Sweden: €0.10 – €0.22/kg with fast processing options

- Italy: €0.30 – €0.65/kg with high fixed contributions

- Netherlands: Uniform fees plus annual registration charges

These variations underscore the importance of meticulous market-by-market fee analysis and compliance strategy.

Key Cost Drivers for Producers

Several factors influence weee compliance fees, especially for cross-border e-commerce brands. The biggest cost drivers include product weight, product category, and the number of units sold per market. However, administrative requirements – such as audit preparation, language translations, and scheme-specific filing formats – can add hidden costs to the compliance journey.

Additionally, changes in EU regulations or national legislation, such as new reporting thresholds or stricter eco-modulation criteria, can quickly shift cost structures from year to year. For companies relying on manual systems or spreadsheets, this adds a substantial administrative burden and increases the risk of non-compliance penalties.

Tips for Budgeting WEEE Compliance

Practically speaking, strategic budgeting is essential to keep weee compliance fees under control. First, conduct an accurate SKU-level classification of all products dispatched in the EU. Each item must be assigned its respective WEEE category – failure to do so leads to misreporting and potential audits. Secondly, build cost models for each market, incorporating current weight-based fees, fixed registration costs, and any applicable eco-modulation incentives or discounts.

Working with compliance partners or platforms can further streamline the budgeting process. These systems can generate predictive cost simulations based on SKU composition and market presence. Finally, regularly audit your compliance inputs to reflect changes in product design, packaging, or materials that can affect your WEEE categorisation.

Case Studies from E-Commerce Brands

Consider the case of EcoTech EU, a mid-sized electronics brand expanding into five EU nations. Initially, they allocated a flat 5% of sales for compliance, but after a full audit and consultation, they learned that in France alone, eco-design advantages could reduce fees by 20%. By redesigning two flagship products with removable batteries and modular housings, they qualified for lower eco-modulated rates.

Similarly, another brand, GreenGadget Ltd, automated their WEEE reporting using a centralised platform that matched SKU data to local compliance categories. This reduced their administrative overhead by 60% and improved filing accuracy. Strategic compliance management not only saved them money but also enhanced their ESG standing with investors and customers.

How EPR Platforms Simplify Compliance

Extended Producer Responsibility (EPR) platforms have become the go-to solution for companies facing complex weee compliance fees. These platforms maintain up-to-date national schemes, automate returns, manage registration documentation, and monitor deadlines. Because the WEEE framework is interconnected with packaging and battery directives, cross-referencing obligations through a single platform allows comprehensive environmental compliance.

Moreover, firms using EPR platforms benefit from audit readiness, automated translation, and real-time fee simulations that help optimise product design decisions before launch. Learn more about EU Extended Producer Responsibility (EPR) & Compliance Fees A growing number of SaaS providers are also integrating with ERP systems to further reduce duplication and data entry errors.

Using Automation Tools to Cut Costs

Automation not only enhances efficiency but directly impacts the bottom line. For example, rule-based reporting tools can assign WEEE categories based on pre-defined criteria, flag edge cases, and enforce weight rounding rules required by specific authorities. Inventory tracking integrated with invoicing platforms ensures that only registered SKUs are sold in compliance-restricted markets.

Additionally, automation tools can alert firms to upcoming regulatory changes, expired certificates, or deviations in cost forecasts versus actual liability. This proactive approach significantly reduces the risk of surcharges and fines. Read a related article

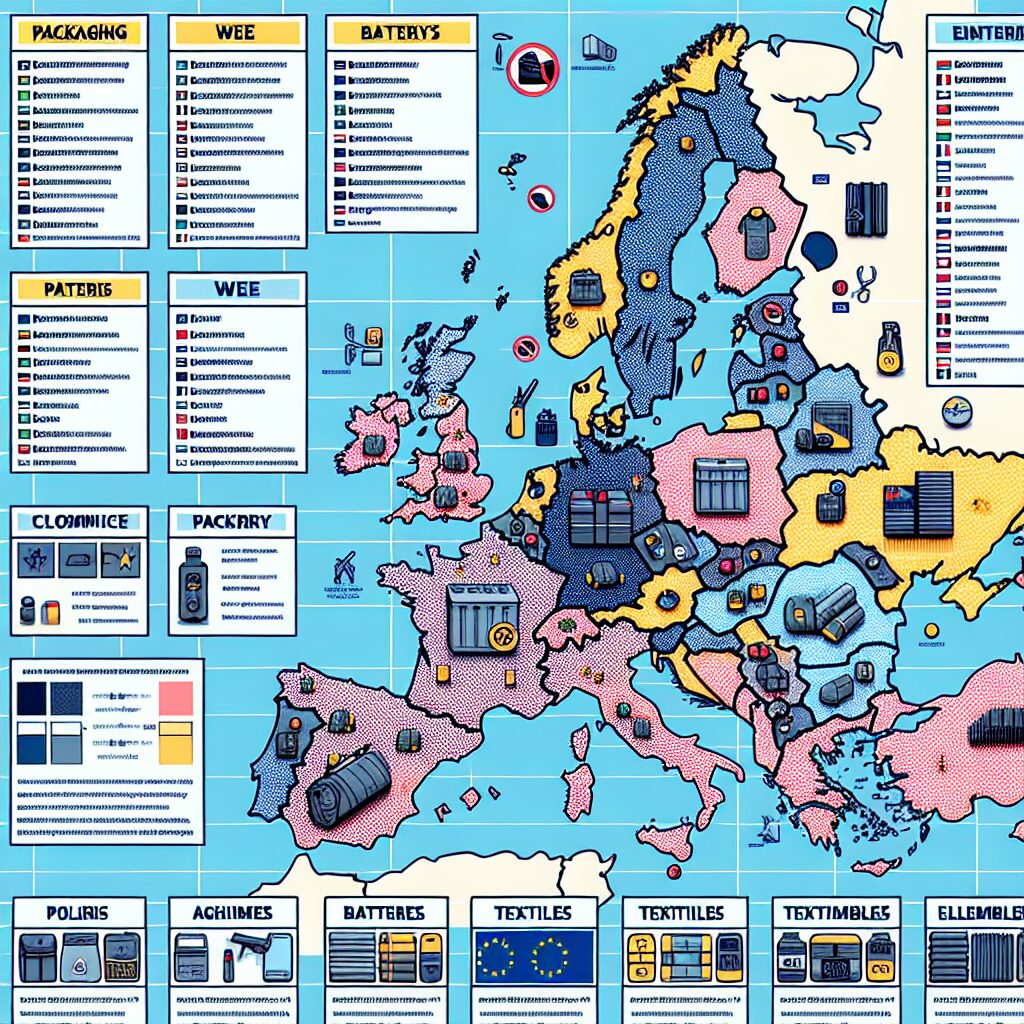

Managing Multi-Country WEEE Registration

Registering for WEEE in one EU country does not imply pan-European recognition. Each Member State operates its own scheme, requiring separate registration numbers, local representatives (for non-EU entities), unique producer identifiers, and often multilingual paperwork. This decentralisation is a major hurdle for cross-border sellers.

The process usually starts with hiring an Authorised Representative (AR) for each market. The AR handles communication with national registers, ensures document fidelity, and prepares submissions on the producer’s behalf. Firms with complex supply chains benefit from consolidating this task via specialised law firms or multinational compliance agencies. Overview of fees and costs by EU country

Future Trends in EU E-Waste Regulation

Looking ahead, the EU continues to evolve its directives to achieve circular economy goals. Expect increasing pressure for product traceability, QR-based labelling, and granular material composition reporting. Additionally, the “Right to Repair” campaign will likely influence future weee compliance fee models, rewarding longer-lasting and repair-friendly devices.

Blockchain registrations and pan-European compliant databases are also under exploration to harmonise fragmented national procedures. Brands that adopt digital compliance frameworks now will gain strategic advantage when these digital reforms become mandatory.

Conclusion: WEEE Cost Planning for 2024

[CONCLUSION_CONTENT]

Great guide on understanding-weee-compliance-fees-eu-markets – Community Feedback

How are WEEE compliance fees calculated across the EU?

WEEE compliance fees in the EU are typically based on the weight and category of electrical and electronic equipment placed on each national market. Costs may include registration, reporting, and scheme management, varying greatly between countries.

Do WEEE compliance fees differ significantly between EU member states?

Yes, WEEE compliance costs can differ widely by country due to national regulations, scheme structures, and administrative fees. It is essential for producers to review each country’s specific requirements and budget accordingly.

Are there ways for brands to optimise or lower their WEEE costs?

Brands can lower costs by consolidating shipments, registering efficiently, using automated reporting, and selecting cost-effective compliance schemes tailored to their product types and sales volumes.